Impulse Shopping & Spending - Check Your Impulse & TEMPO

Change takes effort and can cause stress. To minimize your stress and keep your energy flowing focus on what you can control and the changes you can make for yourself.

Before you make any changes to your spending behaviour, identify the triggers that deplete your personal resources (well-being) and energy and cause you to impulse shop. When you’re heading out the door, keep your TEMPO in mind:

Time of Day

Is there a time when you have more energy? Shop at times of the day or week when you have more energy and feel less stressed and pressured so that you will be able to make wiser choices.

Environment

Are there certain environments that cause you to want to spend or make you feel obligated to spend just because you’re there? For example craft fairs, home shows, malls, electronics stores, when you’re on holidays or away from home on business are all times when it’s easier to spend impulsively. Limit your opportunities to spend in such environments by either not going there or keeping your money safe from yourself. More on that below!

Mood

Certain moods and emotional states deplete your energy resources and can make you more prone to impulse purchasing. Other moods colour your shopping with “rose coloured stickers” and everything looks like a great deal. Identify the moods that affect your spending behaviours: happy, sad, hungry, tired, distracted… and find ways to not shop during moods that will cause you to impulse buy.

Place

Is there a certain store or city that’s your weakness? Do you like to shop for craft supplies at a favourite store? Do you like to wander the aisles in the home improvement or tool store looking for great deals or ideas? Maybe you find yourself impulse shopping when you visit a certain city. If there is a place to avoid, do all that you can to limit your opportunities to go there. If you must still go, then keep your money safe from yourself… more on that shortly.

Occasion

Is there a specific holiday or tradition that causes you to impulse buy? Does shopping with a certain friend contribute to unplanned spending? Do you spend impulsively when you know that you’ll be getting a lump sum of money but you haven’t got it yet, e.g. a bonus at work? Occasion-determined spending can be best controlled by having a budget that allows for seasonal and irregular expenses. Keeping your money safe from yourself will assist with this as well.

Tips to Tie Up Your Funds to Keep Your Money Safe from Yourself!

Despite your best efforts to control your TEMPO and stay on top of your energy resources, you still may need a little help to control your impulse purchasing and to maximize your ability to make wise choices.

Once in Place, This is the Easy Part! Tie Your Money Up to Keep it Safe from Yourself:

- Have two bank accounts and keep your savings separate from your chequing or routine transaction account

- Only allow deposits to your savings account when doing electronic (ABM) or internet banking – set it up so that you have to go to the teller to make a withdrawal

- Set up direct deposit to your savings account for a portion of each pay cheque – out of sight, out of mind

- Move your savings account to a financial institution that you don’t go to frequently

- Take your savings account off of your ATM card or move it to the “other” button so that you can’t access it in the stores

- Lower your cash withdrawal and debit limits on your ATM card

- Remove your payment information from apps and online stores. Make it as hard on yourself as possible to click and buy mindlessly.

- Don’t shop with your credit cards in your wallet – keep them locked up in your safety deposit box

- Keep track of your credit card spending with a cheque register booklet (or tracking notebook) – jot each purchase down as you would do if you were writing cheques. Start with how much is in your account and subtract every purchase regardless of payment method. This gives you a very visual account of what you’ve spent and charged and what you will need to pay for later.

- Only pay with cash – once it’s gone, it’s gone

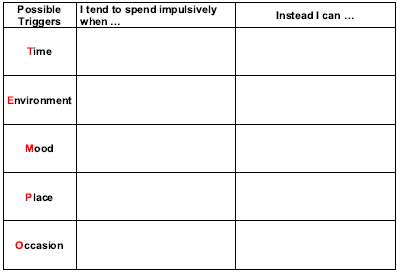

Now that you’re aware of some of your triggers and you’ve tied up your money to keep it safe from yourself, the final step that will help you control your impulse spending behaviour is to plan to walk to a different beat, literally. Fill in the following table based on your TEMPO and plan your steps to change:

TEMPO created by Julie Jaggernath for use by the Credit Counselling Society.