Do You Live In a Financial Danger Zone? | How to Stop Living Pay Cheque to Pay Cheque

Are you living pay cheque to pay cheque and wondering why it feels like your hard earned cash is spent before it even hits your bank account? With family and household expenses ever on the rise, if you’re struggling to survive from one pay to the next, anything unexpected could be the start of a real financial crisis.

Get out of the financial danger zone by breaking the cycle of living pay cheque to pay cheque. It can be done. Here’s how:

Update Your Spending to Match Your Lifestyle

No matter how much you make, stop living pay cheque to pay cheque and avoid a financial disaster.

Recognize that as your lifestyle changes, so must your finances and how you manage money. Where you live, how big or small your family has become, what you do for entertainment and recreation, how much you earn, what you spend on maintaining your household and ultimately, what you deem important, all influence how you spend your money.

Related: What Would a #Throwback Reveal About Your Financial Picture?

Identify the Problem – Ask Yourself If You Spend Too Much or Don’t Earn Enough

Start by deciding if you have an income problem or a spending problem. While the two are related, when forced to take a hard look at their finances, many people realize that they actually earn enough money; it’s what they spend on extras, and not being careful with routine expenses, that’s causing their stress.

Related: How to Save on Routine Expenses

Work With Your Spouse – Start With What You Agree On

When there are two of you managing your household, agree to work together on your finances as well as your communication. Blaming each other or arguing about money management styles and spending decisions, makes it hard to focus on solutions and make changes. You’ve got some work to do to get ahead with your finances; start with what you can agree on.

Related: How to Talk to Your Spouse About Money

Identify Your Priorities and Set Financial Goals

Determine what’s important to you and then set your financial goals accordingly. Once you know which direction you’re heading, use your goals to guide your spending decisions.

Related: How to Set Financial Goals

Track Your Spending and Find Out About Your Spending Habits

Take a month to track your spending. At first it can be tempting to track what you think you should be spending, but that won’t help you identify where your money is actually going. If you are used to using credit cards and rely on them to make ends meet, put them away and track your cash and debit spending.

Related: Free Tools to Track Your Spending

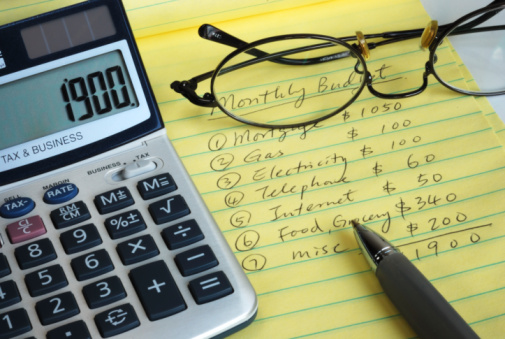

Create a Realistic Personal Budget

Once you have a clear understanding of your spending habits, create a realistic personal budget. Account for all of your regular household and seasonal expenses, as well as your debt payments. Set up electronic transfers and payments and have a shared calendar for all of your money commitments.

Once you have a clear understanding of your spending habits, create a realistic personal budget. Account for all of your regular household and seasonal expenses, as well as your debt payments. Set up electronic transfers and payments and have a shared calendar for all of your money commitments.

Related: Does Being Organized With Money and Finances Really Matter?

Budget for Spending Money

Give yourselves a bit of mad money - cash that each of you can spend without feeling guilty. Mad money, allowance, or whatever you want to call it, when you budget for spending money guilt-free, even just $20 a week, it’ll be easier to stick to your household budget.

Find Simple Ways to Save Money

As you work on your budget, look for opportunities to save and make it better. Cut costs everywhere you can.

Be creative and find simple ways to save money, without having to spend a bundle first:

- Turn the lights off when you leave a room

- Engage the power saver options with your monitors, televisions, or computers

- Wash most of the laundry with cool or cold water

- Only run the dishwasher when it’s full

- Bath your toddler every second day, rather than every day (unless it’s been one of “those” days!)

- Wear slippers and a sweater in the house and turn the heat down a degree or two

- Cancel or suspend cable or other utilities that you’re not fully using

- Check that your hot water tank isn’t turned up too high. If it is, turn it down.

Additional Money Saving Tips:

- 25 Budget Grocery Shopping Tips That Will Save You Money

- 24 Ways to Save on Clothing

- How a Family Can Save as Much as $70 Each Week

Be Careful How Much You Spend to Save

Once your budget has a bit of breathing room, invest in a few items that will save you money in the long run, e.g. a programmable thermostat, low flow shower heads and faucets, heavier window coverings to keep heat in or out, programmable space heaters, or possibly even a more economical vehicle.

It’s easy to think that you need to spend on some of these items before you can start saving money on your household expenses, so challenge yourself to find ways to save before you spend!

Every Little Bit Counts – It’s Up to You to Stop Living Pay Cheque to Pay Cheque

The hardest step of all might be giving yourself permission to make-do with what you can afford. It is, however, a crucial step if you want to start new habits and stop living pay cheque to pay cheque. Ask your friends or family to help you stick to your goals. Explain to them why you’re trying to make some changes – and don’t be surprised if they decide to join you!

By making some hard choices now, you’ll get back on track so that you don’t need to make even tougher choices later.

Related: How to Pay Off Debt & Stay Out of Debt

Join a Free Money Management Webinar: Find out more about topics and scheduled sessions

What is your best tip to help someone stop living pay cheque to pay cheque? Leave a comment below!

<< Go back to the Blog main page

Comments

Anonymous replied on Permalink

how to stop living pay cheque to pay cheque | my money coach

wendy replied on Permalink

All but one of the tips on

Mark replied on Permalink

Acknowledge